Can Credit Cards be Used During Bankruptcy?

You cannot.

However:

- You are probably maxed out anyway before you file bankruptcy.

- Your credit card debt is ever-increasing.

- Your monthly payments are not going to your credit balance but to late fees and interest.

Upon filing of bankruptcy most if not all of your creditors will terminate your credit line.

- You cannot use credit cards during a bankruptcy.

- Until your bankruptcy is closed completely, you should not incur additional debt.

- The purpose of bankruptcy is to reduce or eliminate your debt.

- If you are in bankruptcy and start incurring more debt, you may find your spending behaviors continue.

- You want to establish good credit.

- Also, any debts incurred after the day you file, you are obligated to pay.

The day you file your bankruptcy, those debts included in your bankruptcy petition, are either:

- Wiped out (file Chapter 7 Bankruptcy)

Chapter 7 bankruptcy usually is completed in 90 days; therefore, it will not be long before you can apply for credit again.

- Reduced/Wiped out (file Chapter 13 Bankruptcy).

Chapter 13 Bankruptcy usually has a 3-5 year Plan. Yet many times, during the 3-5 years, you are able to apply for credit.

Most creditors cancel all credit cards/lines/charging privileges upon the filing of a bankruptcy. Credit lines with zero balances are also canceled. Even if you are current on your credit lines/cards, they are canceled by your creditor.

You can pay in cash methods, check, and/or debit.

Now you are on your way to only spending what you can afford for the time being.

Good news about bankruptcy and credit cards:

- You will be able to get credit again.

- During a Chapter 13 Bankruptcy (which is usually a 3-5 year Plan), you may be offered credit.

- There are credit cards similar to debit cards which can be used.

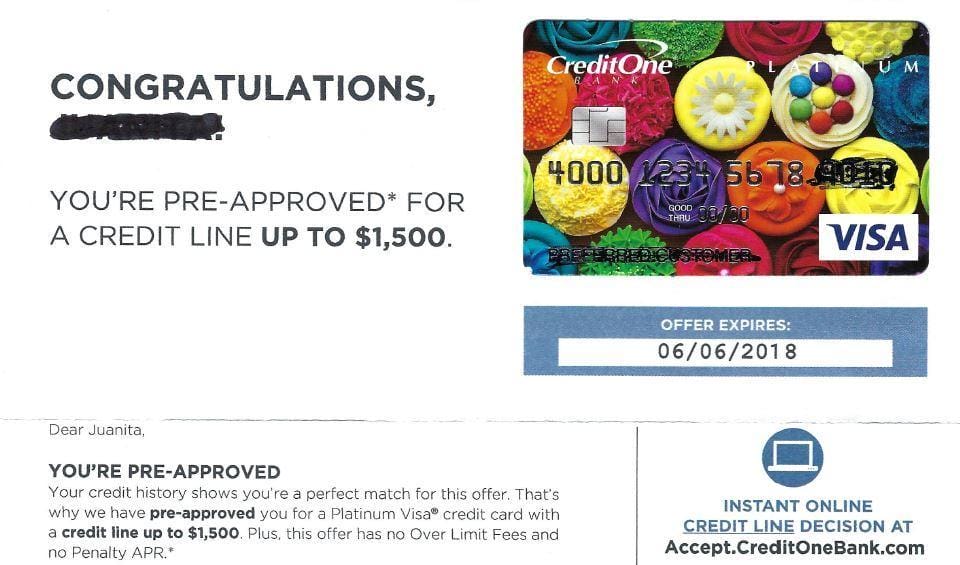

- I received letters (which were sent to me while my clients are in bankruptcy) offering the following:

- VISA – “You’re Pre-Approved for A credit Line up to $1,500” with Cashback rewards.

- Your credit recovers quickly after or during bankruptcy.

- Getting rid of debts through bankruptcy allows you to obtain the credit you need in the future.

- After filing for bankruptcy, your credit score immediately improves.

Increase your Credit Score

When you reach the point of bankruptcy; most often:

- your credit score is very low

- credit cards are maxed out

- you are overwhelmed with past-due payments

- paying the minimum is impossible

- late fees and interest keep piling up – increasing your balance higher and higher

- you keep falling deeper and deeper in debt

- You cannot use your credit cards during bankruptcy. However:

Filing bankruptcy does not hurt you – it helps you.

Eventually, your credit will be cut off if you don’t file bankruptcy and you will still have debts that are ever-increasing.

Another option is if your spouse has little debt or wants to keep the credit, only one file for bankruptcy.

Credit cards can be maintained by the other.

Call Now and I will advise you

if filing bankruptcy is the best option for you.

I am here to help you get out of debt so that you are on your way to a great financial future.

This will help to rebuild your credit and remove your debts for your long-term financial future.

Call Me Today at (201) 446-5904 to set up a free bankruptcy consultation. I provide bankruptcy legal services to:

What is the Average Credit Card Debt in New Jersey?

You are not alone in having credit card debt – let me help you get out of debt.

- The average New Jersey Household debt is $9,468.

Keep in mind making the minimum payments puts you deeper into debt.

- New Jersey ranks 9th in the United States with Credit Card Debt.

- Contact me Now

Credit card interest rates can creep up on you without notice. You may find yourself only able to make the minimum monthly payments, and yet your balances continue to grow. Depending on the cost of living, many households end up charging more on their credit cards.

Credit card debt is a major factor in determining a borrower’s credit score. Lenders will also report a borrower’s payment activity to credit bureaus each month. Delinquent payments detract from a borrower’s credit score while on-time payments help their credit score.

You can stop the cycle of escalating credit debt and get bankruptcy help.

Can Credit Cards Be Used During Bankruptcy?

The answer is No – However, filing bankruptcy has many benefits. One is that you can rebuild your credit immediately after filing bankruptcy.

If you are looking to file bankruptcy, you are often being denied credit and your credit cards are maxed out and some in collections.

Call me Today: Ralph A. Ferro, Jr., Esq.

(201) 446-5904

I will help you get out of debt and get you bankruptcy protection.