As we look at bankruptcy, an important question appears. Is the United States headed for bankruptcy? I can help you if you believe you are headed to bankruptcy. There is not much any one person can do to help the U.S. economy but I can help you personally.

A household that cannot acquire the funds to repay debts may consider bankruptcy. This helps the household to work through its financial struggles. Businesses of all shapes and sizes pursue bankruptcy when they cannot pay their creditors. They can then restructure in order to make another attempt at a profitable situation. Even some municipalities, evidenced by many recent areas in California, enter into bankruptcy when they cannot balance their budgets.

Is the U.S. federal government headed down the same path to bankruptcy?

Whether or not the U.S. is headed for bankruptcy is a question that is on the minds of many people inside and outside of the government. The Deficit, which refers to the amount of money that is needed to operate the government beyond what it collects in revenue, has repeatedly exceeded $1 trillion. The National Debt grows at a rate of approximately $3.8 billion each day. It is currently at $16 trillion with no true end in sight.

Solvency Without Bankruptcy Thoughts

Plans to resolve these fiscal issues facing the nation are few and far between. Many suggest an increase of taxes while others suggest a decrease in expenditures on certain government programs. The Simpson-Bowles Commission, a bi-partisan committee that was tasked with handling the debt crisis, suggested a combination of the two ideas. The same was true with Congressman and former Vice Presidential nominee Paul Ryan’s controversial “Path to Prosperity.” The former did not receive the votes it needed to pass. It was also not backed by the President. The latter was loudly decried as having too many cuts to entitlement programs, particularly the changes that were suggested for Medicare.

Unfortunately, either simple cuts or tax raises will not work on their own to lead the country to a balanced budget. Even more unfortunately, Democrats and Republicans are unlikely to work together to find a solution in the near future. Indeed, the Senate has been unable to pass an effective budget for quite some time.

Unless swift action takes place, bankruptcy for the country may become a reality

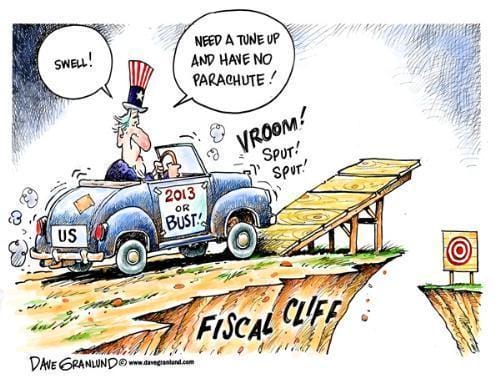

The Fiscal Cliff History

The Budget Control Act of 2011 was signed by President Obama to handle the looming debt-ceiling crisis. Unless a compromise can be made, at midnight on December 31, certain measures will go into place to attempt to balance the budget. Some of these measures include:

- A two percent tax increase on all workers

- An end to the Bush tax cuts

- Significant cuts to defense and non-defense discretionary spending

If the Fiscal Cliff is to be avoided, Congress must act quickly. This may be an impossible task as a bi-partisan group of senators have worked together for over a year to find an alternative solution to the country’s deficit problem. As yet, no agreements have been made. Republicans continue to push for an extension of the Bush tax cuts for all citizens while the President has promised to veto any attempts at extending these cuts for the wealthy.

Regardless of the answer to the bankruptcy question, Presidents should consider a new US Treasury Secretary that has a history with bankruptcy. Should the country need to formally file for bankruptcy? This is appearing more and more the likely, the Secretary of Treasury will be needed to guide the federal government through what could potentially be a very long process.

Are you Headed to Bankruptcy?

I evaluate on a daily basis personal and business financial situation. Is the United States headed to bankruptcy?

Do you have questions about your own bankruptcy options? I offer a free bankruptcy consultation. Contact me today and I will meet with you personally. Ralph A. Ferro, Jr., Esq. – Board Certified Bankruptcy Lawyer.